Enhancing Anti-Money Laundering and Countering the Financing of Terrorism Audit Effectiveness: Insights from the Anti-Money Laundering Audit Peer Group Best Practice Paper

As financial crime risks continue to evolve, expectations on internal audit functions to assess the adequacy and effectiveness of AML/CFT controls have intensified. A webinar on 10 July 2025 organised by IIA Singapore examined key insights from the Anti-Money Laundering Audit Peer Group (AAPG) Best Practice Paper, with a focus on strengthening audit practices in line with regulatory expectations.

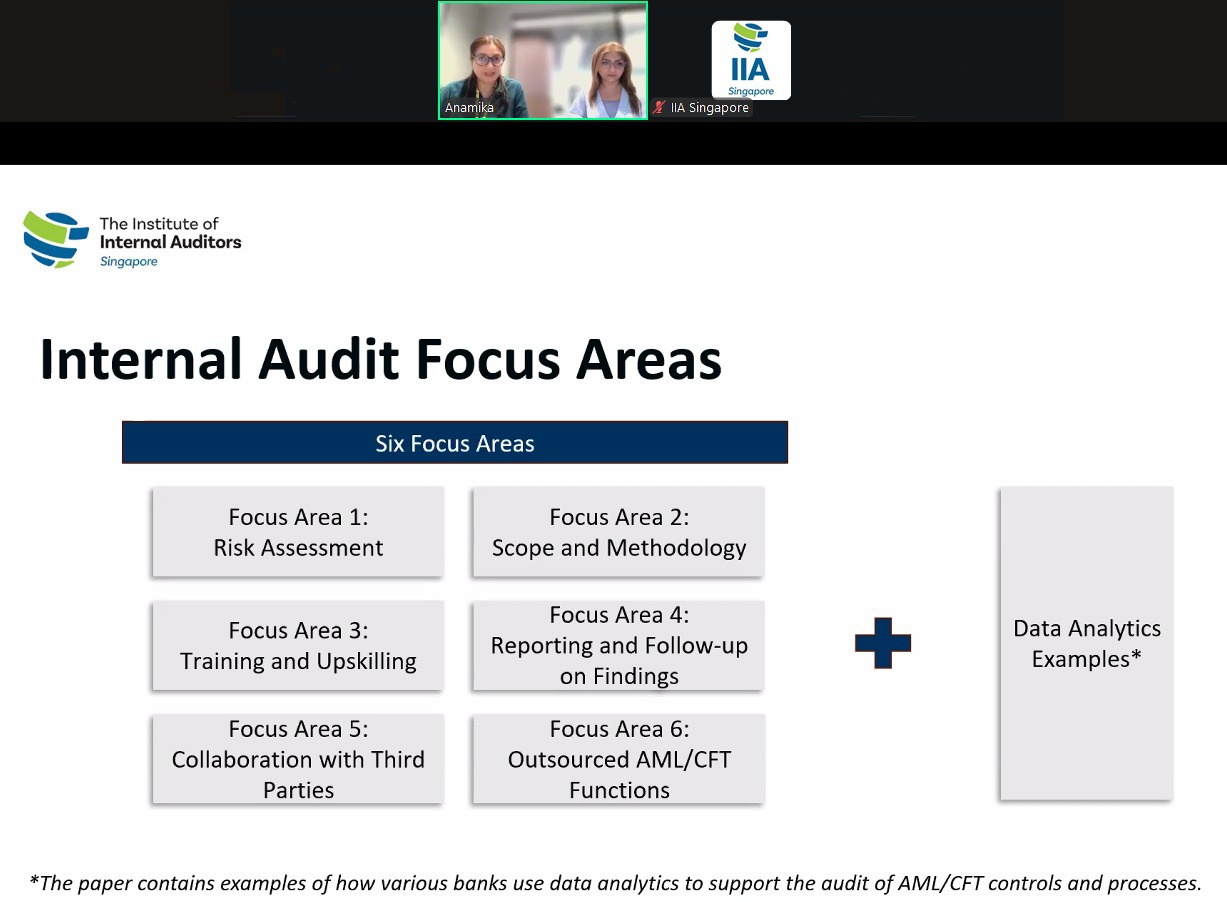

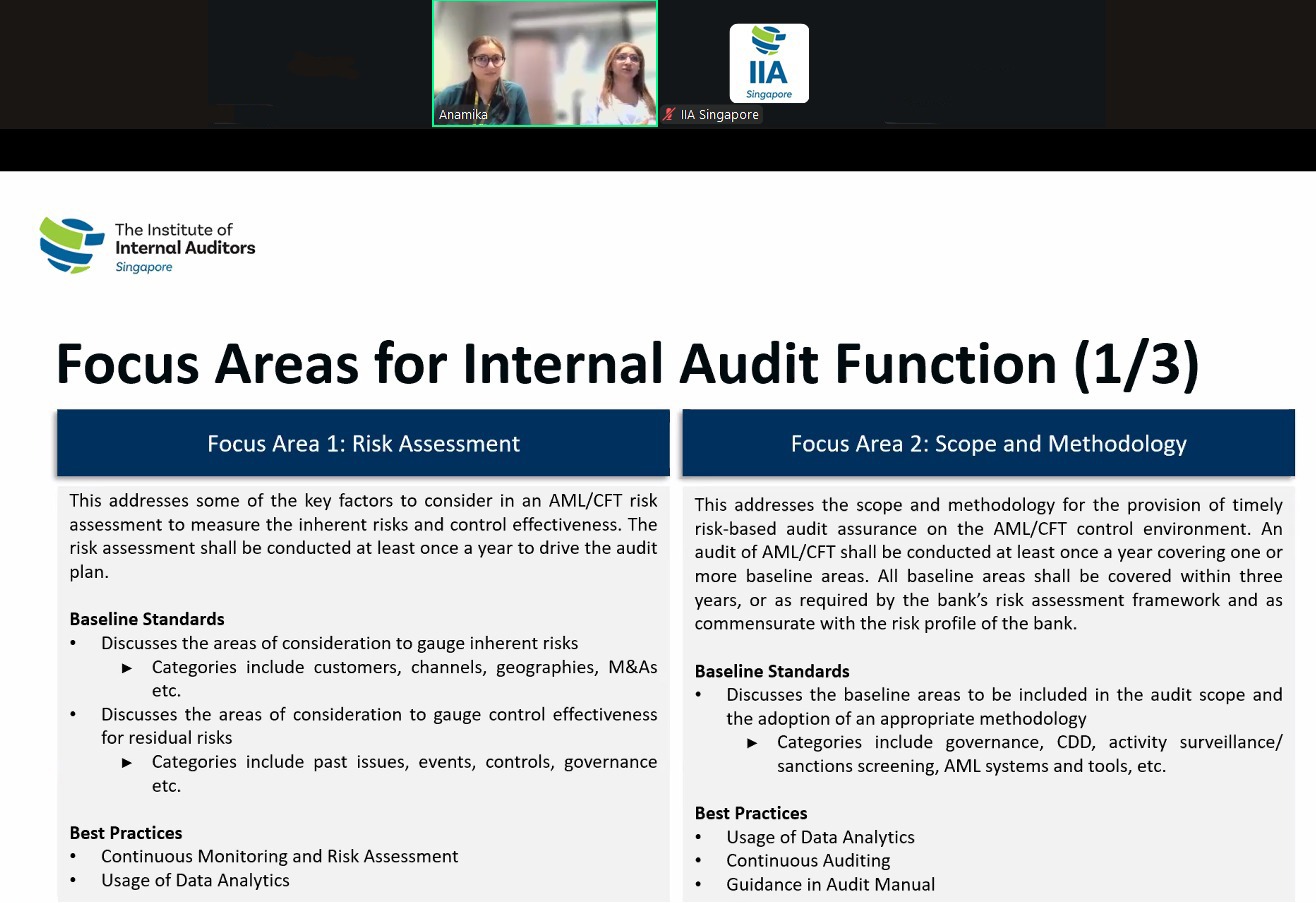

Drawing from the paper and recent industry developments, the speakers - Radish Singh, ASEAN Financial Services Risk Management Leader, and Anamika Guha Thakurta, Associate Director, Financial Services Risk Management - both from EY Singapore, discussed how internal audit functions can remain effective and relevant across the Monetary Authority of Singapore’s six focus areas for AML/CFT audits. Participants were encouraged to leverage data analytics to enhance the precision and coverage of their audits, especially in identifying higher-risk activities in a dynamic operating environment. Other areas highlighted included the need for closer collaboration with third parties and external audit providers, as well as the importance of training and upskilling internal audit teams to keep pace with regulatory changes. The session also underscored the value of clearly defined audit scopes, particularly where internal and external auditors are both involved, to ensure a comprehensive and coordinated approach.

The AAPG was established in October 2022 to foster knowledge sharing, strengthen AML/CFT audit practices, and enhance collaboration with the regulator and the broader audit community.