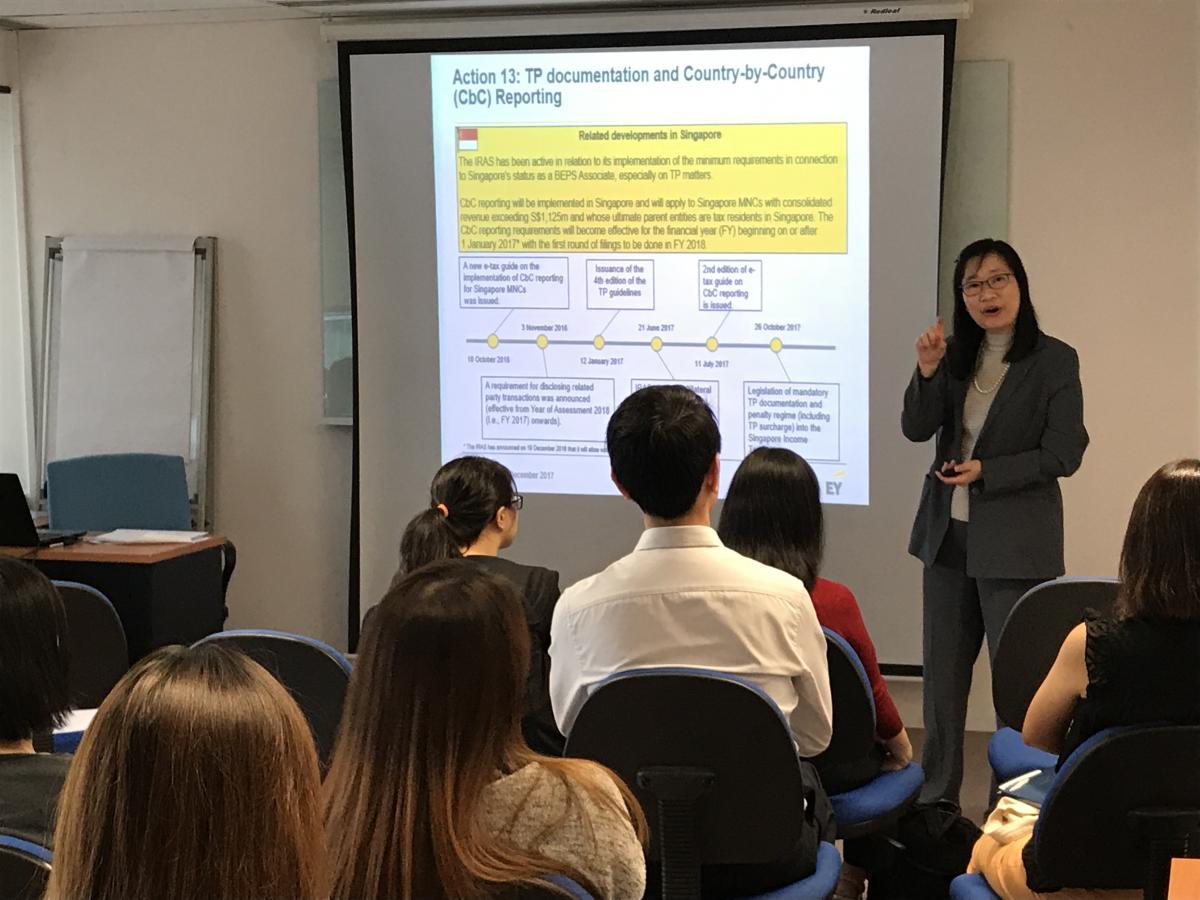

Learn At Lunch: Tax in the Limelight

The Organisation for Economic Co-operation and Development (OECD) aims to address government concerns about MNCs being able to organise their profits in ways that allow them to be effectively taxed at a lower rate. In October 2015, the OECD finalised its 15-point action plan recommending changes to international tax laws and treaties that governments can implement to reduce the potential for base erosion and profit shifting (BEPS).

With a changing global tax landscape, it is inevitable that tax has risen to the Board’s agenda and receiving heightened attention. Recognising this, 16 internal audit professionals attended a Learn at Lunch on 14 December 2017 to find out more about the BEPS project, Singapore’s BEPS journey, and the implications to Internal Audit. Generally, the aims of the BEPS recommendations are threefold: tax laws of countries should be internationally coherent and should not leave any income double-taxed; tax authorities should obtain insight into the global operations of taxpayers and be able to share relevant tax information with each other; and profit should be taxed where value is created.

“Taxation risks are not new to any organisation. However, changes arising from BEPS will heighten this and bring it to the forefront of the Board and Audit Committee’s attention. Addressing tax risk goes well beyond the adherence with the application of taxation laws. Internal audit has the duty to be aware of and keep pace with the latest tax developments, such as BEPS, so that it can continue to be the voice of influence and deliver value for the organisation,” said Mrs Chung-Sim Siew Moon, Partner, Head of Tax at EY, who gave the presentation.

“The new BEPS rules will have tax implications across almost all aspects of an organisation’s operations from people, business processes to supply chain network and footprint. This project will not be an endpoint but rather a journey. Just as companies have to ensure that their tax function is aligned with other parts of the business, internal audit too has to take a proactive approach in making sure that taxation risks are incorporated into strategic decision making as part of the overall enterprise risk management process,” said one of the participants, Mr Lai Hoong Chee, Internal Audit Manager, Asia, Accudyne Industries Asia Pte Ltd.

|

|

|

|

|

View here for more photos.