Internal Auditors Value to the Audit Committee During A Regulatory Investigation

When a financial fraud allegation is made against a public listed company, the Audit Committee (AC) is often faced with the question of how to carry out an effective independent investigation. An investigation can be a time intensive and financially consuming process, and the AC, in their capacity as independent directors, are also bound by relevant local rules, regulations and laws to address the questions of who was involved in the fraud and whether the directors and/or management took appropriate action to prevent, detect and remediate the situation.

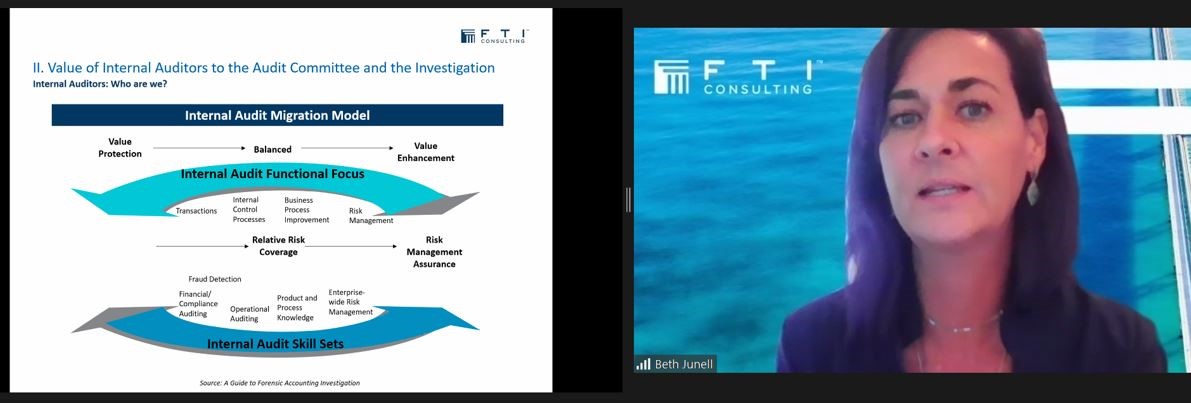

Over 190 participants attended the webinar “Internal Auditors' Value to the Audit Committee During A Regulatory Investigation” on 11 November 2021. Presented by Beth Junell and Ben Ee from FTI Consulting, the speakers shared their insights on these areas:

1. The AC’s legal obligations;

2. Various stakeholders’ expectations (including the regulators, stock exchange and external auditors) for the investigation;

3. How an independent investigation is conducted;

4. The tools necessary to conduct a holistic investigation; and

5. The value of internal auditors to the AC and investigation